The Telegraph and The Spectator are operating in a state of limbo.

Despite the auction process to buy Telegraph Media Group last year being cut short by a blockbuster £1.2bn bid in collaboration with former owners the Barclay family, the future of the news organisation remains uncertain.

The latest reports suggest that former Chancellor and Evening Standard editor George Osborne is now involved and question whether TMG chief executive Nick Hugh will stay.

Meanwhile, a claim of suspicious financial activity at the group is reportedly being investigated.

What is the latest situation with the Telegraph sale?

In early December, the Barclay family took back control of TMG six months after it was repossessed by Lloyds Banking Group because of their debts of around £1bn.

Several prominent media figures expressed an interest in taking part in the auction process for The Telegraph, including Mail, Metro and i owner Lord Rothermere, National World executive chairman David Montgomery, GB News investor Sir Paul Marshall, and former Le Monde investor Daniel Křetínský. Axel Springer pulled out of the running in November while former Telegraph editor William Lewis was lining up funders before accepting the Washington Post chief executive job.

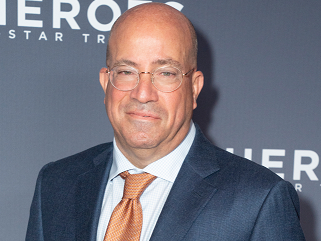

But the Barclays family were able to circumvent the auction process by securing repayment of their full debt to Lloyds in a deal with Abu Dhabi-backed investment fund Redbird IMI, which is led by former CNN president Jeff Zucker as chief executive.

Content from our partners

Redbird IMI subsequently notified TMG’s independent directors, in place for the duration of the sale process, of its intention to carry out its debt-for-equity swap with the Barclays.

Its loan was made up of £600m secured against The Telegraph and The Spectator and a similar amount secured against other Barclay businesses and commercial interests.

This will make it the effective owner of TMG despite further changes being on hold under a Public Interest Intervention Notice (PIIN) while the deal is investigated by Ofcom and the Competition and Markets Authority.

The PIIN stops transfer of ownership of the business without written consent from Culture Secretary Lucy Frazer, means it cannot be merged with any other company, that no significant changes should be made to its management and oversight, and that key editorial staff are not to be removed or transferred without permission.

Why is The Telegraph sale being investigated?

Redbird IMI is a joint venture between US investment firm Redbird Capital and International Media Investments of Abu Dhabi. IMI is led by UAE vice president Sheikh Mansour, who also owns Manchester City Football Club.

Although Zucker has insisted Abu Dhabi’s IMI, which owns about three-quarters of Redbird IMI, is only a “passive investor”, there are concerns about the potential influence of that foreign investment on the newspaper and its political influence in the UK.

In an attempt to smooth the deal an IMI spokesperson has stated: “This is a business investment for us and we will play no part in the running of the Telegraph or the Spectator.”

Zucker has touted potential tactics to reassure the Government that the editorial independence of the newsbrands will be kept intact, for example through an editorial advisory board.

However, Culture Secretary Frazer said “there may be public interest considerations… and that these concerns warrant further investigation”.

She therefore asked Ofcom to report to her on any potential public interest concerns, and for the Competition and Markets Authority to report back on whether there may be concerns about whether the deal could result in a substantial lessening of competition in the UK.

Despite being commonly known as the broadcast regulator, Ofcom is reporting to Frazer on whether there may be public interest concerns about the need for accurate presentation of news and the need for free expression of opinion in newspapers arising from the deal.

This is because the Communications Act 2003 specifies that Ofcom is the body that can investigate matters of public interest arising from the merger of newspapers or broadcast media companies when requested by the Secretary of State. The Act gave Ofcom competition powers equivalent to the then-Office of Fair Trading.

Ofcom must report to the Culture Secretary by midnight on 26 January with advice about whether further investigation into the deal is recommended.

What else has changed this month?

The National Crime Agency is reportedly investigating a report of suspicious financial activity at TMG made by the directors put in place for the duration of the sale, according to The Times which cited senior sources at the company.

The Sunday Times later reported that Redbird IMI has recruited boutique investment bank Robey Warshaw, at which George Osborne is a partner, to help it secure the deal amid the political pressure.

Emily Sheffield, Osborne’s successor as Evening Standard editor and sister-in-law of his former Government colleague David Cameron, criticised Osborne’s apparent involvement on X/Twitter: “No depths? A former Chancellor aiding a state to buy one of our media institutions?@George_Osborne There is a precedent being set here & you know it. Principles do matter.”

Meanwhile the FT has reported that TMG chief executive Nick Hugh is expected to stand down after almost seven years as part of the process, but this remains speculation.

Former Hearst UK chief executive Anna Jones, currently an adviser at TMG, is said to be a favourite successor internally if the role does need filling.

Separately chief financial officer Cormac O’Shea is leaving next month after just over two years in the role.

Sky News reported that group financial controller Cathy Southgate has been appointed acting chief financial officer to succeed O’Shea. It is unclear whether the company had to seek approval from the Government for her appointment under the terms of the PIIN.

What happens next?

After Ofcom and the CMA report to the Culture Secretary on 26 January, Frazer will decide whether to ask the competition watchdog to launch a Phase 2 merger investigation which could take around six months.

If the deal is ultimately blocked as a result of public interest concerns, the sale process will have to begin again.

Redbird IMI has been insisting it will be “solely responsible for any potential sale of the Telegraph” because of the deal that has already taken place.

But it said it has not to date had any discussions about selling the business on, despite reports suggesting it might be frustrated and voluntarily begin the process if the Government investigation continues to the next stage.

What do journalists at The Telegraph think?

The Telegraph has featured stories critical of the deal on several front pages in the past couple of months. For example, one front page headline this month read: “Block UAE-backed takeover of Telegraph, dozens of MPs urge.”

And at the bottom of its reporting on the sale, it is encouraging readers to share their views with a message that reads: “Many of our readers have raised concerns over the potential sale of Telegraph Media Group to the Abu Dhabi-linked Redbird IMI. While Ofcom carries out its investigation we are inviting the submission of comments on the process. Email salecomments@telegraph.co.uk to have your say.”

Several of its female journalists in particular have spoken out due to concerns around Abu Dhabi’s track record on women’s rights. Features writer and columnist Judith Woods wrote: “Make no mistake if we are taken under the control of Abu Dhabi this paper’s female voices will be silenced. Including mine.” Zucker subsequently told The Sunday Times that he would be responsible for the running of the title and he would “never tolerate any issues for women”.

However, the newspaper has also published columnists who are in favour of the deal, such as former Cabinet minister Brandon Lewis who noted that “this is not a foreign state takeover, but rather a corporate acquisition led by a prominent figure in the American media landscape”.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our “Letters Page” blog