So many FAST services, so little time! Viewers have access to an unprecedented amount of free streaming TV content. However, FAST fragmentation means they will never know that most of it exists!

FAST market fragmentation is bad and getting worse

There are more than 22 FAST platforms available to viewers in the US. According to streammetrics.com, the top 12 offer over 3600 channels, with LocalNow offering nearly 500, Plex 428, and Pluto TV 406. Of course, there is massive duplication of channels between them. Popular channels like FailArmy, Cheddar News, and World Poker Tour are available on most platforms, but hundreds of other channels appear on one or two of them only.

There are more than 22 FAST platforms available to viewers in the US. According to streammetrics.com, the top 12 offer over 3600 channels, with LocalNow offering nearly 500, Plex 428, and Pluto TV 406. Of course, there is massive duplication of channels between them. Popular channels like FailArmy, Cheddar News, and World Poker Tour are available on most platforms, but hundreds of other channels appear on one or two of them only.

New platforms continue to enter the market. Last week, Google TV announced it would provide a suite of free channels built into the Live Guide and new integrations with other FAST providers. The guide can now provide access to over 800 channels. WB Discovery says it will launch a FAST service in 2023. Many of the channels it provides will likely be unique, drawing from the vast library of content available from Warner Bros., Warner Media, and Discovery.

This fragmentation causes massive problems for viewers.

Thinking beyond the default

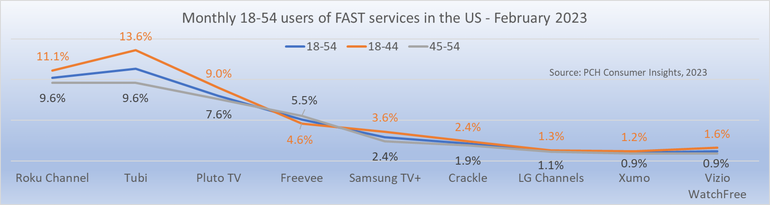

For viewers, figuring out which FAST service best fits them is difficult and results in them needing multiple options. TiVo says that the average US and Canadian used 3.9 non-paid services in Q4 2022, up from 2.4 one year early. Most gravitate toward the top providers like Pluto TV and Tubi, which have established their brands with many viewers. When those viewers think of free TV, they head to those apps. PCH Consumer Insights says 11.3% use Tubi monthly, 10.2% Roku Channel, and 8% Pluto TV.

Services built-in to TVs also come with natural advantages, though they still seem to struggle to break through with viewers. LG TVs provide the built-in Channels FAST service with 350 channels, and Samsung’s TV Plus offers 264 channels.

But how does a viewer evaluate which FAST service is best for them? And how do they determine which service has the channel they want?

Few tools are available to compare services

Beyond the 30-year-old grid guide provided by many FAST services, few tools are available to viewers to mine the content effectively. And with most FAST services providing 200 or more channels, scrolling through the guide rapidly becomes an exercise in futility rather than a pleasant discovery.

TV platforms often don’t include all the FAST channels in the title search results. Since many of the channels provided are series-based (devoted to a single title), viewers are missing out on a large pool of content in a familiar, easy-to-consume format. For example, about a quarter of Pluto TV channels are based on a single show, and more than a third of FreeVee channels are made up of a single title. But searching for, say, the Let’s Make a Deal channel (currently available on Pluto TV) on a Samsung TV or Fire TV, a viewer would never know it was there.

channels are made up of a single title. But searching for, say, the Let’s Make a Deal channel (currently available on Pluto TV) on a Samsung TV or Fire TV, a viewer would never know it was there.

Companion apps provide limited help

One place viewers are increasingly turning to for help is companion apps. These services help viewers navigate the complicated world of Internet TV. TiVo says 35% of US and Canadian adults were using them in Q4 2022, up from 29% six months earlier. Though they cover free on-demand offerings, they typically do not cover FAST linear channels. For example, the search results for FailArmy in Reelgood and JustWatch return no results.

Fragmentation has negative effects on content providers and advertisers. To understand what they are and better understand the FAST market, you need to watch my new class Getting to Grips with FAST: a Primer on Free Ad-Supported Streaming TV. Whether new to or immersed in the market, we’ve got you covered. The class defines key terms, explains how the market grew so quickly, reveals the superpower of each of the top FAST services, and tells you where the market is headed. It leverages the latest data putting it in context, so you leave understanding the dimensions of the FAST market, why it got that way, and where it is going. So, grab your notebook, and let’s get started!